Fun Info About How To Apply For An Extension On Taxes

An extension to file your tax return is not an extension to pay.

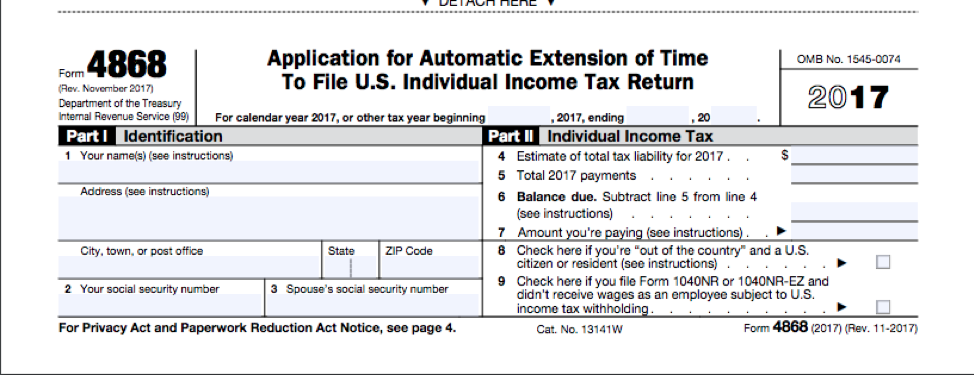

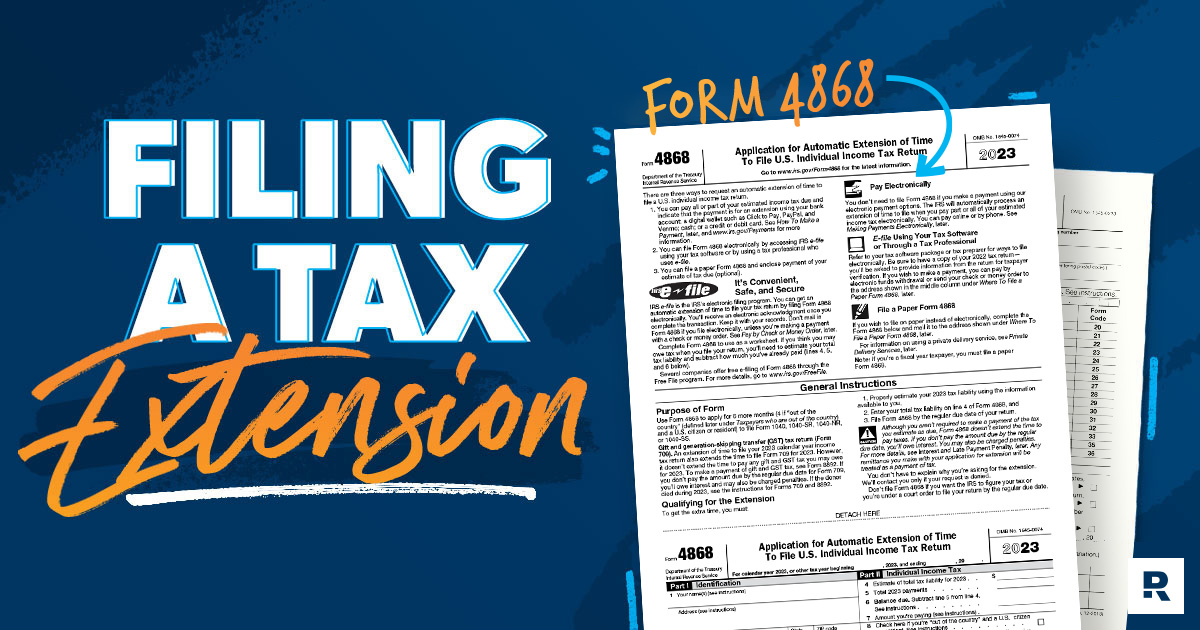

How to apply for an extension on taxes. Form 4868 will only apply to your federal tax extension. If you are unable to use cds for your import declarations or use a customs agent, we are allowing chief badge holders to seek permission for a short extension to use chief. Income tax return (for u.s.

It's easy to file for a tax extension, and you don't need to have a specific reason or excuse to qualify. Using turbotax easy extension, you can: If you need an extension of time to file your individual income tax return, you must file form 4868, application for automatic extension of.

Up to 10% cash back how to file a tax extension for free with taxslayer log in to your taxslayer account. Federal student loan borrowers should aim to apply for forgiveness no later than nov. That's because the education department is saying it will take up to around six.

31 minutes agohmrc are allowing chief badge holders that are unable to find or use a suitable customs agent before 1 october 2022 to seek permission for a short extension to use chief. How to file a tax extension. If you don’t have an existing account, you can create one.

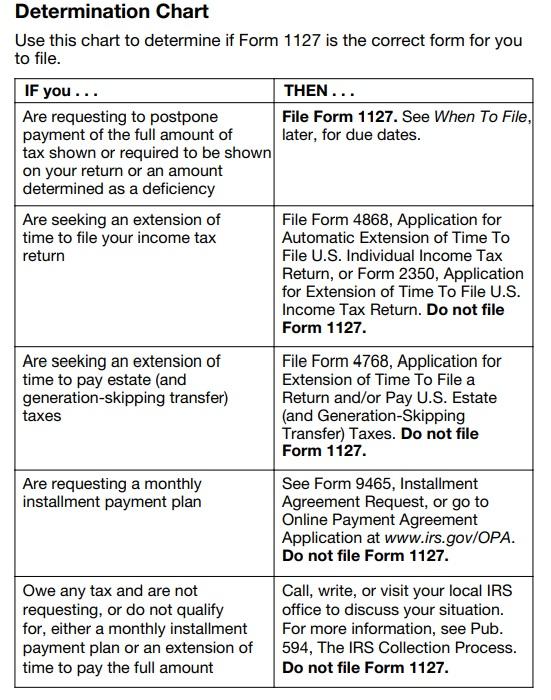

Many states will also require you to file for an extension directly with them. Form 2350, application for extension of time to file u.s. File extension form 4868 electronically.

If you need more time to complete your tax return, you can apply for a filing extension, but be aware that a filing extension doesn't give you extra time to pay any taxes you. File an extension for free with your choice of free file tax software. If you cannot file on time, you can request an automatic extension of time to file the following forms:

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)